Never Forget To Compare Travel Insurance

On this page, we delve into the world of travel insurance and compare different options available in the market. Whether you're embarking on a solo backpacking trip or planning a luxurious family vacation, finding the right travel insurance policy is key to ensuring a worry-free journey.

So let's dive in and explore how IATI Travel Insurance stacks up against other providers including SafetyWing when it comes to providing value-for-money coverage.

Why Travel Insurance Is Important

Travel insurance is often seen as an unnecessary expense, but the reality is that it can save you from a whole lot of trouble and unexpected expenses in the long run. Picture this: you've been looking forward to your dream vacation for months, and just a few days before departure, you fall ill and are unable to travel. Without travel insurance, you could end up losing all the money you invested in flights, accommodations, and activities.

AnnieWall: Find local activitiesBut it's not just medical emergencies that travel insurance covers. It also provides protection against lost or stolen luggage, trip cancellations or delays due to unforeseen circumstances like natural disasters or airline strikes. Imagine arriving at your destination only to find out that your suitcase has gone missing or worse - having your passport stolen! Travel insurance ensures that you are financially covered for such mishaps.

One aspect of travel insurance that is often overlooked is emergency medical coverage. While we hope nothing bad happens during our travels, accidents do occur unexpectedly. Having adequate health coverage while abroad gives us peace of mind knowing that we will receive necessary medical attention without worrying about hefty bills.

Additionally, some countries require visitors to have valid travel insurance as part of their entry requirements. This means if you don't have the proper coverage in place when entering certain destinations, you may be denied entry or face other legal consequences.

Comparing Travel Insurance

When it comes to planning your next adventure, one thing you should never overlook is travel insurance. It's an essential tool that can provide peace of mind and financial protection in case anything goes wrong during your trip. But with so many options out there, how do you know which travel insurance policy is right for you?

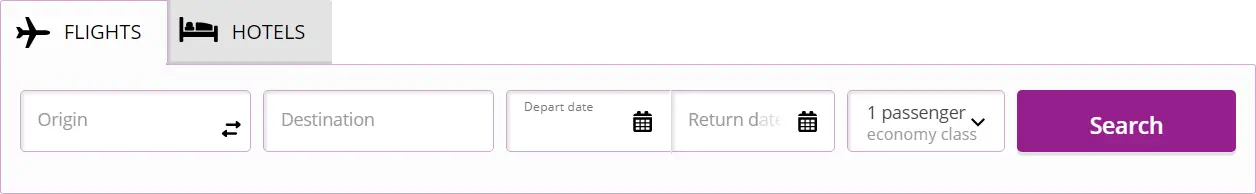

Comparing travel insurance policies can be a bit overwhelming, but taking the time to research and compare different plans can save you both time and money in the long run. Start by considering what type of coverage you need. Are you looking for basic medical coverage or do you want additional benefits such as trip cancellation or lost baggage protection? Understanding your needs will help narrow down your options.

Next, consider the cost of each policy. While price shouldn't be the sole determining factor, it's important to find a plan that fits within your budget. Look for policies that offer good value for money – ones that provide comprehensive coverage at a reasonable price.

Another important aspect to compare is the level of customer service provided by each insurer. You want to make sure that if something does go wrong during your trip, you'll have access to prompt assistance and support.

By comparing different travel insurance policies based on coverage, cost, customer service, and reviews from fellow travelers; finding the right one for your needs becomes much easier. Remember that choosing appropriate travel insurance is an investment in protecting yourself against unforeseen circumstances while exploring new destinations

Travel Insurance And Value For Money

When it comes to travel insurance, getting the best value for your money is essential. You want coverage that not only meets your needs but also fits within your budget.

IATI offers a range of comprehensive plans at competitive prices. Whether you're looking for basic coverage or more extensive protection, IATI has options to suit every traveler's requirements. But, as always, shopping around is the smart thing to do.

With IATI travel insurance, you can customize your policy to include additional benefits such as trip cancellation/interruption, baggage loss/delay coverage, and medical expenses. This flexibility allows you to tailor the plan according to your specific needs.

Is IATA insurance the only option for digital nomads? If you are looking for a more up-to-date insurance concept, you should take a look at SafetyWing Insurance. SafetyWing does not only cover individual travelers, it is one of the insurance providers that cover teams. Traveling in teams or groups is increasingly becoming more popular.

Another important aspect of SafetyWing Travel Insurance is access to a remote doctor. If you can't find a doctor on the remote island you are visiting, having access to a remote doctor is an important factor.

Conclusion

Traveling without adequate insurance can leave you vulnerable financially and emotionally! Don't take unnecessary risks! Secure yourself with reliable travel insurance for peace of mind. It is the best way to enjoy your vacation or digital nomad adventure.

Michel Pinson is a Travel enthusiast and Content Creator. Merging passion for education and exploration, he iscommitted to sharing knowledge and inspiring others through captivating educational content. Bringing the world closer together by empowering individuals with global expertise and a sense of wanderlust.