Global Health Insurance Review

Global health insurance is long-term insurance that is comprehensive and suitable for both one person and the whole family. Health insurance is very important in today's world, especially if you have to live and work in two countries, or if you really like to travel around the world.

Features of global health insurance

With the global health insurance program, you can easily choose the area of coverage that will be covered by the insurance. There are two coverage areas to choose from:

- Any point on the planet except the USA, Canada, China, Hong Kong, Japan, Macau, Singapore and Taiwan;

- Coverage around the world.

In addition, the insured is free to choose a healthcare provider - this can be very important if you have something in mind.

Overview of the global health insurance system

If you love traveling around the world, or if you live in two different countries, then you know for sure that this is all connected with many difficulties, including health insurance. Health insurance is worth considering even if you are a completely healthy person, and if there are any problems in your body, then global health insurance should be your lifesaver.

What is special about IMG Global Health Insurance? First of all, you can choose a tariff plan, since it is available in several options, and a flexible coverage area makes it possible to customize insurance individually for each person or family. Before applying for insurance, the system must necessarily familiarize yourself with your medical history and your family members, who will also be included in the insurance. This will allow the program to choose an individual insurance option in order to expand it as much as possible, based on your needs.

You should be aware that IGM has a whole huge department that makes sure that global health coverage is affordable for everyone, even as healthcare costs only increase every year.

Global health coverage is available with a dedicated MyIMG Travel Intelligence mobile phone toolkit. This set includes special programs and information methods that can warn of threats, weather, and even traffic delays, focusing on a specific location.

IGM can easily give its customers peace of mind when choosing global health insurance so that the insured can receive high-quality care at any time, no matter where they are in the world.

Benefits of IGM Global Health Insurance

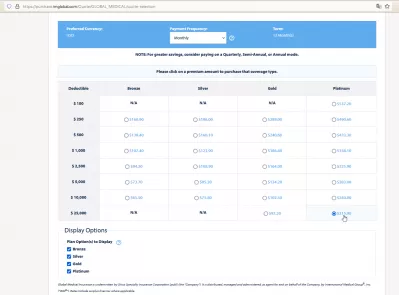

Global health insurance has four categories: bronze, silver, gold and platinum. Depending on each of these levels, the number of benefits that are added to the insurance varies.

Bronze Status Features

Let's look at the key points that the bronze status of global health insurance gives, and to be more precise, the benefits that the insured person or his family receives.

- Maximum life limit: $1,000,000 per person;

- Outpatient Clinic: The insured can spend a maximum of $300 per visit to the doctor. This list includes any outpatient tests; $250 can be spent on x-ray visits. $500 is available for the collection of specialists or physicians both before and after inpatient treatment.

- If the insured is admitted to the emergency department, this is only covered if admitted to a hospital.

- For CT, MRI, echocardiography, endoscopy, gastroscopy, and cytoscopies, a maximum of $600 per procedure is allocated.

- For an assistant surgeon during an operation - 20 percent of the rate of the main surgeon.

- This includes physical therapy. Here, too, there is a limit - $ 40 per visit, while you can visit the procedure ten times. This option is available for three months after inpatient treatment or surgery.

- Transplants have a lifetime limit of $250,000 maximum.

- The insured may apply to the local ambulance in case of injury or any illness that led to hospitalization. The limit for this event is $1,500.

- Emergency evacuation is also included in this plan, although the limit is for life, and has a size of $50,000.

- An interdepartmental ambulance transfer is available - transportation of a patient from one medical institution to another. A limit of $1,500 is available for one insurance transfer.

- If something irreparable has happened, and you need to return the remains to their homeland, then the bronze level gives a limit of $ 10,000 for this.

- Dental trauma treatment has a $1,000 limit for the entire coverage period.

And this is only the minimum of what is included in the bronze level of global health insurance. As you can see from what has been written, global health insurance from IGM even at the bronze level includes a huge list of services, respectively, at other levels, the limits and the number of services increase and only become more profitable.

Silver status features

- Maximum life insurance limit: $5,000,000 for each person covered by the insurance.

- Franchise fees can range from $250 to $10,000.

- Outpatient Clinic: There is a $300 limit per visit that includes lab tests; there is also a $250 limit for x-ray visits. There are 25 combined visits available, each costing no more than $70 per visit, either examination, or specific specialist fee. This also includes a chiropractor, although a special medical order or treatment plan is required. There is a maximum limit of $500 for a surgical consultation.

- Mental or neurological treatment is available on an outpatient basis only after a year of continuous coverage.

- If hospitalization is required, or room and board, then a limit of $ 600 per day is available, a maximum of 240 days can be covered by insurance.

- At the silver level, an intensive care unit is available, but there are limits here too: $ 1,500 per day - a total of 180 days are available.

- CT, MRI, echocardiography, endoscopy, gastroscopy, and cystoscopy are also available, and have a limit of $600 per service.

- Physiotherapy can be visited 30 times, and one visit should cost no more than $40.

- Transplants have the same lifetime limit as the Bronze level of $250,000.

- Local emergency care for an injury or illness that results in hospitalization is available at a cap of $1,500 per event.

- Just like the bronze tier, emergency evacuation is available here with the same limit of $50,000 per coverage period.

- An interdepartmental ambulance transfer is available - transportation of a patient from one medical institution to another. A limit of $1,500 is available for one insurance transfer.

- The return of mortal remains to their homeland is also included in the insurance, at this level, a limit of $ 25,000 for life is available for this service.

- Dental trauma treatment has a $1,000 limit for the entire coverage period.

- Global health insurance at this level includes preventive care for children, the limit is $70 per visit, 3 visits are available per coverage period.

Gold Status Features

IGM Global Health Insurance Gold status provides insured individuals with even more benefits than the tiers already discussed.

- Maximum life limit: $5,000,000 per person.

- Deductible (per coverage period): $250 to $25,000.

- Outpatient treatment with deductible and co-insurance.

- Mental or neurological treatment: $10,000 maximum per coverage period with a maximum $50,000 coverage period – available after 12 months of continuous coverage.

- Hospital Emergency Department: Including deductible and co-insurance.

- Hospitalization plus room and board: including deductible and co-insurance for the average cost of a semi-private room.

- Intensive Care Unit: Including deductible and co-insurance.

- CT, MRI, echocardiography, endoscopy, gastroscopy and cytoscopy: subject to deductible and co-insurance.

- Podiatric care: $750 maximum limit.

- Physical Therapy: Including deductible and co-insurance, maximum $50 per visit.

- Transplants: Maximum $1,000,000 for a lifetime.

- Local ambulance for injury or illness resulting in hospitalization: including deductible and co-insurance.

- Emergency evacuation: up to the maximum life limit. Not franchised or co-insurable.

- Return of mortal remains: $25,000 maximum for life - no deductible or co-insurance.

- Hospital Reimbursement: Private Hospitals: $400 per night and a maximum limit of $4,000 per coverage period. Public hospitals: $500 per night and a maximum limit of $5,000 per coverage period.

- Adult Prophylaxis: $250 per coverage period. Not franchised or co-insurable.

- Preventive Care for Children: $200 maximum per coverage period. Not franchised or co-insurable.

Platinum Status Features

- Maximum life limit: $8,000,000 per person.

- Deductible (per coverage period): $100 to $25,000.

- Mental or neurological treatment: $50,000 maximum for the entire term - available after 12 months of continuous coverage.

- Hospital Emergency Department: Including deductible and co-insurance. Additional deductible of $250.

- Hospitalization, room and board: including deductible and co-insurance for the average cost of a single room.

- CT, MRI, echocardiography, endoscopy, gastroscopy and cytoscopy: subject to deductible and co-insurance.

- Maternity (Birth, Prevention, Newborn and Birth Care, Pregnancy Family Matters Program): $2,500 additional deductible per pregnancy. $50,000 maximum for life. $200 preventive care allowance for newborns for the first 31 days - 12 months after birth. Maximum $250,000 for neonatal and congenital medical care during the first 31 days after birth.

- Physical Therapy: Deductible and co-insurance included, but $50 maximum per visit.

- Transplants: maximum $2,000,000 for a lifetime.

- Local ambulance for injury or illness resulting in hospitalization: not deductible or co-insurable.

- Emergency evacuation: up to the maximum limit of life. Not franchised or co-insurable.

- Interagency Ambulance Transfer: Not franchised or co-insurable, US only.

- Political evacuation and repatriation: $10,000 maximum for life.

- Remote transport: $5,000 per coverage period up to $20,000 for the entire duration. Not franchised or co-insurable.

- Return of mortal remains: $50,000 maximum for life - no deductible or co-insurance.

- Complementary Medicine: $500 maximum limit per coverage period.

Thus, global health insurance covers a huge number of services that may be required at any time. The higher the level, starting from bronze, the higher the range of opportunities for insured persons.

Frequently Asked Questions

- How can global medical insurance reviews help you?

- Today, global health insurance is very important for those who like to travel or live often in different fears. This insurance can protect the health of you and your family anywhere in the world.