Cheap Car Rental Insurance Makes Traveling Less Expensive

Traveling creates so much room for growth. You are exposed to various things that you may not be exposed to in your hometown – different cultures, different personalities, and even different architecture.

Despite traveling being a life-altering experience that all should encounter, many do not because it is a form of luxury.

When you are traveling, you still have to pay your rent, your car payment, and every other bill associated with living. Additionally, you have to pay for somewhere to sleep, a car to drive, and food to eat while you are traveling and exploring the new places that you are temporarily staying in.

Many middle class or even lower class individuals live paycheck to paycheck – they can barely grow a savings account. Scavenging extra funds to travel to a new city does not seem feasible.

You even need to purchase insurance for the car you are renting. When I bought my first car, I struggled to find insurance due to my low stream of income. Imagine the strain to keep up with paying the minimum insurance for the car you use to get to your low paying job.

Now that you have that visual, consider how exhausting it is to add on an expense that is not a necessity like car insurance! Most, if not all, people living paycheck-to-paycheck do not even entertain the thought of traveling because of this reason.

However, the truth is that traveling on a budget is a possibility for many people, even if they don’t think so. There are plenty who live on a tight income that can find a way to travel by following certain tips and tricks.

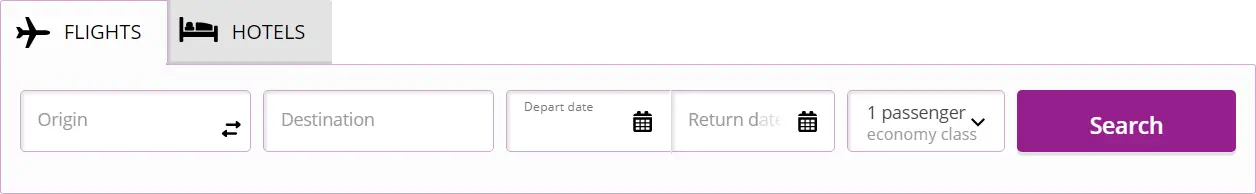

One of the tricks to making traveling less of a major expense is by trimming the cost of travel by finding the cheapest airfare, rental car price, and affordable rental car insurance.

Car rental insurance

Car rental is a service that gives mobility and comfort of movement in any situation. It allows you to forget about public transport, arrive on time for business meetings and make plans on your own, without focusing on the schedule of minibuses. An important stage of car rental is car insurance against popular risks that may arise during the trip. Today we will tell you more about how insurance is issued when renting a car, and what it includes.

Three Types of Rental Car Coverage

There are three ways that you can get coverage for the car you are renting while out of town:

- Using the insurance you have on the car you are driving at home

- Using the rental coverage plans that various rental agencies offer

- Using coverage from a third-party rental service

Rental Car Insurance From Rental Companies

When I book online, I prefer to use a booking website because you tend to find the cheapest flights and rentals. No matter which company I booked my rental through, all of them were extremely pushy when it came to getting me to buy the rental coverage they offer.

Rental coverage is often called a collision damage waiver (CDW) or loss damage waiver (LDW).

Once you add the CDW to your rental agreement, you are basically forgiven for any damage that happens to the rental car. Although some companies have variations within their agreements so you should thoroughly read your rental contract.

Being waived for any damage that has occurred to a vehicle within your possession alleviates stress while driving the rental, but CDWs can be expensive. They can cost around $30 a day, sometimes higher.

If you do not get into an accident, you would have wasted $30 a day. For some, the stress-less traveling makes it worth it, but for others, rental car insurance merely causes financial stresses after the vacation ends.

Rental Car Insurance from Your Personal Insurance Company

The first step you should take when finding a cheap alternative for a rental car is reaching out to your personal insurance provider. You can ask a representative or look at your policy to see if your insurance coverage is transferable to rental cars.

If it is, then in most cases your rental car will be covered the same way your personal car is. Your insurance representative will be able to give you more information about what all is covered for your rental car.

One drawback with this is that your personal insurance may not cover all of the fees that rental agencies can charge if your rental is stolen or if you get into a car accident.

Your personal insurance will mainly cover the physical damage to your rental car and any medical costs that need to be covered for the opposing party, but the meaning behind “damage” can vary depending on the rental company.

They can disperse fees for “loss of use,” which is a fee charged to you in the amount of what the company could have made during the time it takes to repair or replace the rented vehicle.

Outside of that fee, rental car companies can charge policy claim fees, towing charges, and a diminished value fee, a fee for the car losing resale value because of the incident. Your personal insurance will not cover these excess fees unless specifically stated in your policy.

Rental Car Insurance from Credit Card

Just as you can go through a third-party agency to book your flights, hotels, and cars, you can go through one to book your rental car insurance.

At almost any big-time online travel agency, you can buy collision coverage for your rentals. This coverage can cost about $10 a day. Collision coverage is a form of insurance that protects cars in the case that physical damage or theft occurs.

On a different note, depending on your credit card benefits, you could automatically have collision coverage if you book your rental car on your card. The coverage extends to physical damage, theft, loss-of-use fees, and towing charges.

This is a “free route” one can take when choosing rental insurance. However, it does not always cover diminished value or the fee accessed when filing a claim and other administrative actions.

Depending on the type of card and company you are with, premium credit cards allow you to use their coverage as the primary protection which makes them fully responsible for the rental. Most credit card benefits are used as secondary coverages.

How to Choose Rental Car Insurance

Choosing coverage directly through your rental provider is a great way to ensure you have a stress-free trip. You will also have the convenience of not going through the process of filing claims because you are waived from the damage.

Despite the convenience of it all, the cost of CDW is not ideal if you are tightly budgeting the trip expenses. For budgeting purposes, you can use your personal insurance and credit card collision coverage simultaneously.

Use your personal insurance as a primary extension to your rental car while your credit card benefits acts as a secondary provider. This will allow you to keep to your travel budget.

This route can be quick and simple but before choosing this method, it is best to read all of the fine-print with both insurers. Credit card companies can withhold coverage for damage and theft until they receive the rental company’s log of the damage as a form of verifiable documentation.

It sounds straightforward, but rental companies do not always agree to those terms and refuse to send the logs. So you can get stuck with the remaining bill. Even without the secondary coverage from your credit card, you may still have to pay your money because rental agencies generally require you to pay the damage claim upfront.

After you file a claim and have paid the deductible on your personal insurance, then hopefully, you will receive the damage claim and your deductible back. This applies to every option other than purchasing a CDW or LDW.

The Right Rental Car Coverage for You

You can save money no matter the route you choose, but the route depends on different variations. For instance, one person may drive more safely than another while one group of friends may be visiting a higher populated area than another.

Either circumstance would alter what choice you make regarding rental car insurance. No matter which option you pick, make sure you have enough coverage for your personal needs.

Imani Francies writes and researches for the auto insurance comparison site, BuyAutoInsurance.com. She earned a Bachelor of Arts in Film and Media and specializes in various forms of media marketing.